AAT LEVEL 2 (MODULE 2/4) Principles Of Bookkeeping Controls POBC COURSE

The bookkeeping controls unit is about control accounts, journals and methods of payment. It takes students through reconciliation processes and the use of the journal to the stage of redrafting the trial balance, following initial adjustments. This unit covers more complex Foundation level bookkeeping procedures, which will enable students to.

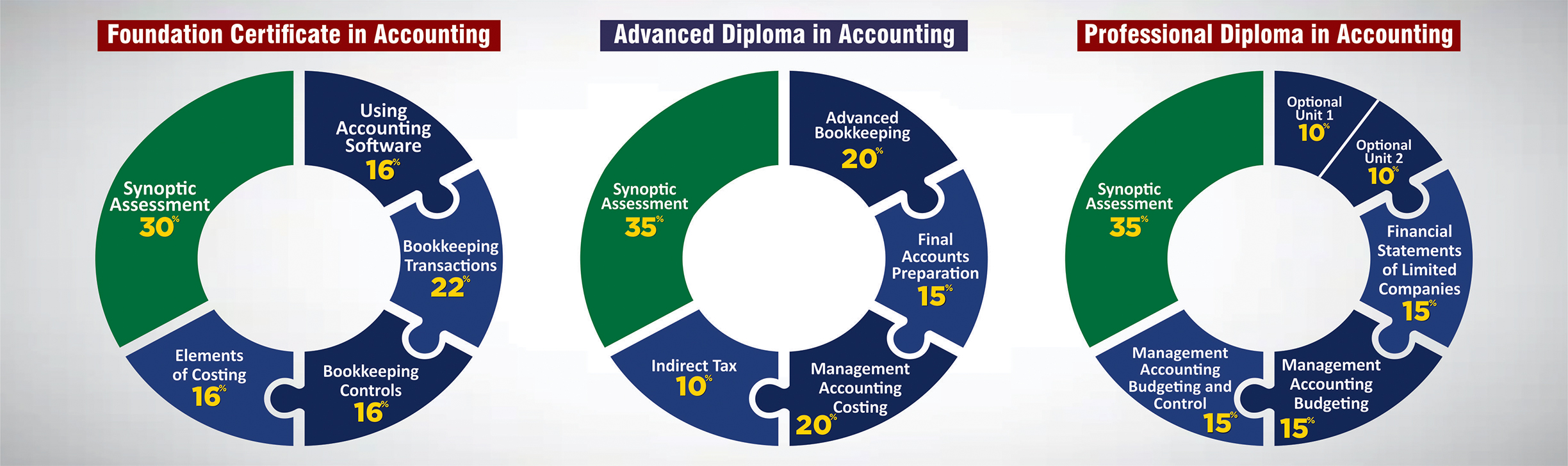

AAT Level 2 Certificate in Accounting Assistant Accountant Apprenticeship

The course is structured with a combination of interactive lectures & quizzes, exam revision questions and mock exams. The Learnsignal guide to passing Principles of Bookkeeping Controls: Study with an AAT Approved Training Provider. Study the whole syllabus. Follow a guided study plan. Practice exam style questions.

AAT Level 2 & 3 Certificates in Bookkeeping AATQB IdealSchools

The payable and receivable control accounts show [the totals of all ledgers or the totals of the customer and supplier accounts]. They are used to monitor the total amount owing on sales and purchases invoices. The balance of the sales ledger control account must equal the [purchase ledger or sales ledger], we would also record any.

AAT Level 2 Bookkeeping Transactions BTRN revision lecture YouTube

Performing a Bank Reconciliation. - Step 1: Check the opening balance on the bank statement agrees with that of the cash book. This will identify any prior issues. Work through all the bank receipts listed in the cash book (debit side), comparing each entry to the receipts on the bank statement.

eagle education aat level 2

AAT Q2022 Principles of Bookkeeping Controls (POBC) Exam Kit. Valid from 27 September 2022 to 31 August 2024. Designed to enhance your revision, the exam kit has everything you need to know before going into your exam, including practice questions and knowledge checks. US $ 30.00. Printed 2022-2024 edition.

AAT Level 1 Award in Bookkeeping Training Link

PDF File; AAT L2 Introduction to Bookkeeping:. AAT L2 Principles of Bookkeeping Controls: Mock Exam One PDF. Download 0.6MB. AAT L2 Principles of Costing: Mock Exam One PDF. Download 0.5MB. AAT L2 Principles of Costing (study text, chapter 7 activities) Excel SS. Download 0.2MB.

AAT Level 2 Principles of Bookkeeping Controls (POBC) Study Text Kaplan Learning

Have you watched Part 1 yet? Watch it here: https://youtu.be/b6LAqj2_e3A?list=PLO9a94T_bMruNTmMQ_uRCZF-YEanJ2us_If you've found our videos helpful, we also o.

AAT Q2022 Level 2 Certificate in Accounting First Intuition

Study with Quizlet and memorize flashcards containing terms like What payment methods have no effect on the bank balance?, What 2 payment methods reduce the bank balance at a later date?, What are the other 8 payment methods which reduce the bank balance on the date of withdrawal? and more.

AAT Level 3 Advanced Certificate in Bookkeeping Southend Adult Community College

There are over 30 different quizzes at both level 1 and level 2. You can see the answers at the end of each quiz. Top Picks. Year 1 - Double-entry bookkeeping: first principles. Student Zone . When you purchase any Tutorial or Workbook in Osborne Books' AAT Accounting range, you will receive free online access to an eBook, practice tests.

AAT Question bank Level 2 Foundation Certificate in Accounting — AAT Discussion forums

AAT Q2022 Principles of Bookkeeping Controls (POBC) Essentials Pack. Valid from 27 September 2022 to 31 August 2024. Valid from 27 September 2022 to 31 August 2024. Valid from 27 September 2022 to 31 August 2024. All the books and materials you'll need to pass Principles of Bookkeeping Controls, including Study Text, Exam Kit and Pocket Notes.

AAT Level 2 Certificate in Bookkeeping

2. However, cheques are still used for payments made by post e.g. payment of bills. 3. Cheques have to include: - The correct date including the year.-The name of the person / business receiving the money. - The amount in words (except pence which can be in figures). - The amount in figures. - Counterfoil - Authorised signature 4. You must pay.

AAT Level 3 in Birmingham AAT Level 3

Exam Kit. The AAT Principles of Bookkeeping Controls Exam Kit complements the Study Text, providing exam-style questions about control accounts, reconciling bank statements with the cash book, using the journal and producing trial balances. Ideal for getting exam-ready. Printed £21.00 + Delivery eBook. View details.

AAT Level 2 Introduction to Bookkeeping FIVE AAT Practice Assessments (Q2022) (AAT Level 2

To find the VAT amount you have £528 representing 120% (if you added 20% VAT to the net amount of 100%). £528 ÷ 120% x 20% = VAT £88. Alternatively, 20%/120% = 1/6 as a fraction. 1/6 x £528 = VAT £88. The remaining amount of the cash sale is recorded as cash sales (£528 total received less £88 VAT) = £440.

AAT Accounting Level 2

This essential study text for the AAT Level 2 Certificate in Accounting fully prepares you to pass the Q2022 Unit 'Principles of Bookkeeping Controls'. You will build on your knowledge of double-entry bookkeeping, exploring control accounts, journals and reconciliations. You will also learn more about digital bookkeeping systems and.

AAT Level 2 Accounting Live Online McArthur

resource controlled by the business as a result of past events and from which future economic benefits (money) are expected to flow to the business. Premises, machines, motor vehicles, office equipment or furniture and fittings. Inventory currently for resale. Trade receivables (money to be 'received').

AAT Level 2 Different Cost Types YouTube

The competency level for AAT assessment is 70%. Learning outcomes Weighting 1 Understand payment methods 5% 2 Understand controls in a bookkeeping system 5% 3 Use control accounts 20% 4 Use the journal 50% 5 Reconcile bank statement with the cash book 20% Total 100%